Getting The What happens if my reverse mortgage loan balance grows To Work

Our Reverse Mortgage - Las Vegas Diaries

This is called a "reverse" mortgage, since in contrast to a conventional mortgage, the lending institution makes the payments to the customer. Reverse home mortgage fast view Readily available to homeowners 62 and older One-time FHA MI charge of 2% of the home's worth Obtain approximately 80% of the house's value Debtor must have enough equity to certify Utilized for main house only No prepayment charge Your Custom-made Reverse Home Loan Quote Start your complimentary quote from Mann Home loan How much money can you borrow? The quantity of money a debtor can get through a reverse home mortgage depends on their age, the current reverse mortgage/HECM rate of interest, their present home mortgage balance if they have one, and what an independent appraiser determines as their home's current value.

Conventional Loans - Superior Mortgage Lending, LLC.

Reverse Mortgage of Las Vegas - Highest Rated Reverse Mortgage Lender in Las Vegas

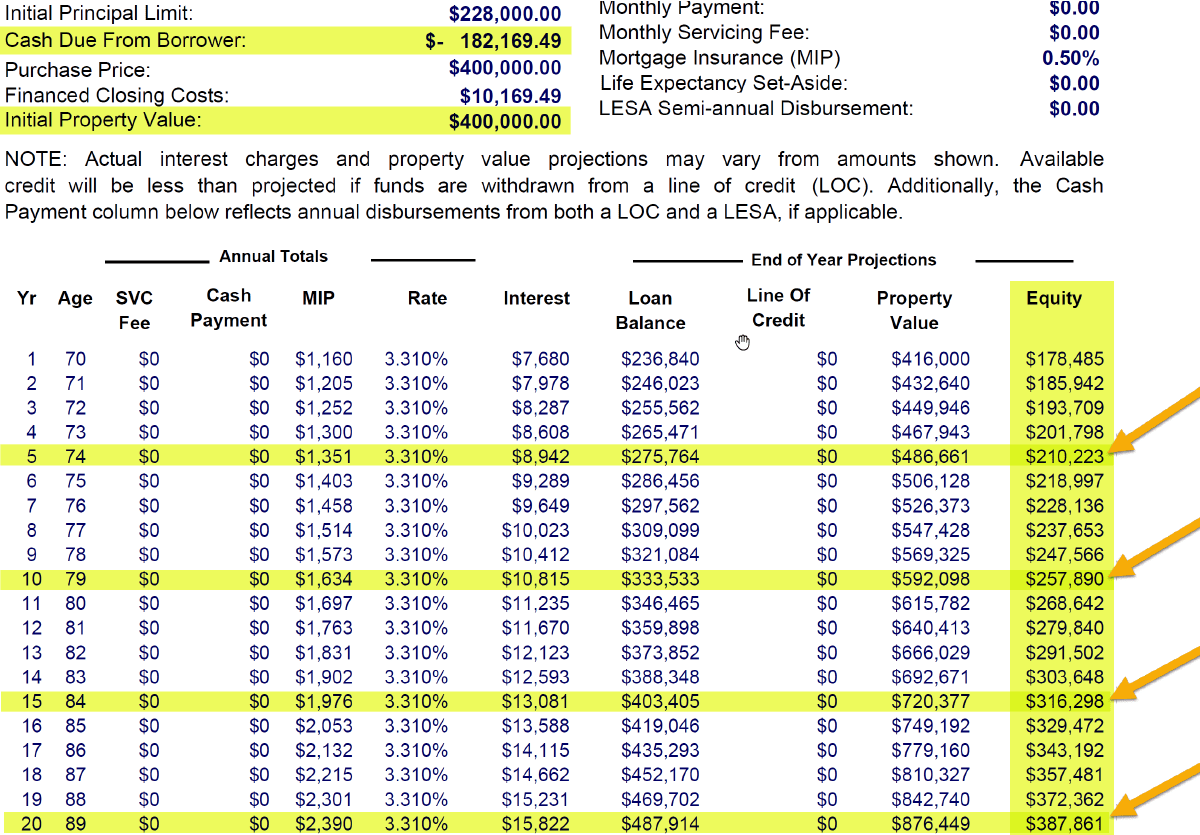

Home equity is the difference in between what a house owner owes in a home loan compared to what their house deserves. If a home is worth $300,000 and they owe $150,000 on their home mortgage, they would have $150,000 in home equity. Key obligations of homeowners with a reverse home mortgage House owners with a reverse home mortgage have 3 primary duties: The borrower must in the house as a main house The customer must preserve the house in good condition Taxes, insurance and other home ownership cost should be paid Pros of a reverse mortgage It may be a good choice for homeowners with minimal income and a great deal of equity in their home.

3 Best Mortgage Companies in Las Vegas, NV - Expert Recommendations

The reverse home loan might also be utilized to pay off their preliminary mortgage so they will no longer need to make regular monthly payments. Cons of a reverse home loan The primary balance will increase over time as the interest and FHA MI costs accumulate. Know that if a debtor isn't utilizing the home as a main residence, it might result in the loan needing to be repaid sooner.

What will a reverse home loan expense? Upfront, debtors will pay an origination charge, closing costs, and an FHA MI charge of 2% of the house's evaluated value. Continuous expenses consist of a yearly FHA MI of 0. 5% of the impressive loan balance. When Check For Updates is due, the principal and interest are gathered.